10 Minutes That Changed India: Inside the ₹40 Billion Quick Commerce Revolution

The explosive rise of 10-minute delivery is reshaping India's retail landscape forever.

Hello Readers

Welcome to another edition of The Valuation Story

The way Indians shop is changing dramatically. Remember rushing to the local kirana store when you suddenly ran out of milk?

Or realizing at 9 PM that you need ingredients for tomorrow's breakfast?

Those days are quickly becoming history.

I've been fascinated by the rapid rise of quick commerce in India - platforms like Blinkit, Zepto, and Swiggy Instamart that promise to deliver groceries and essentials within 10-15 minutes. What started as a convenience during pandemic lockdowns has evolved into a habit for millions of urban Indians.

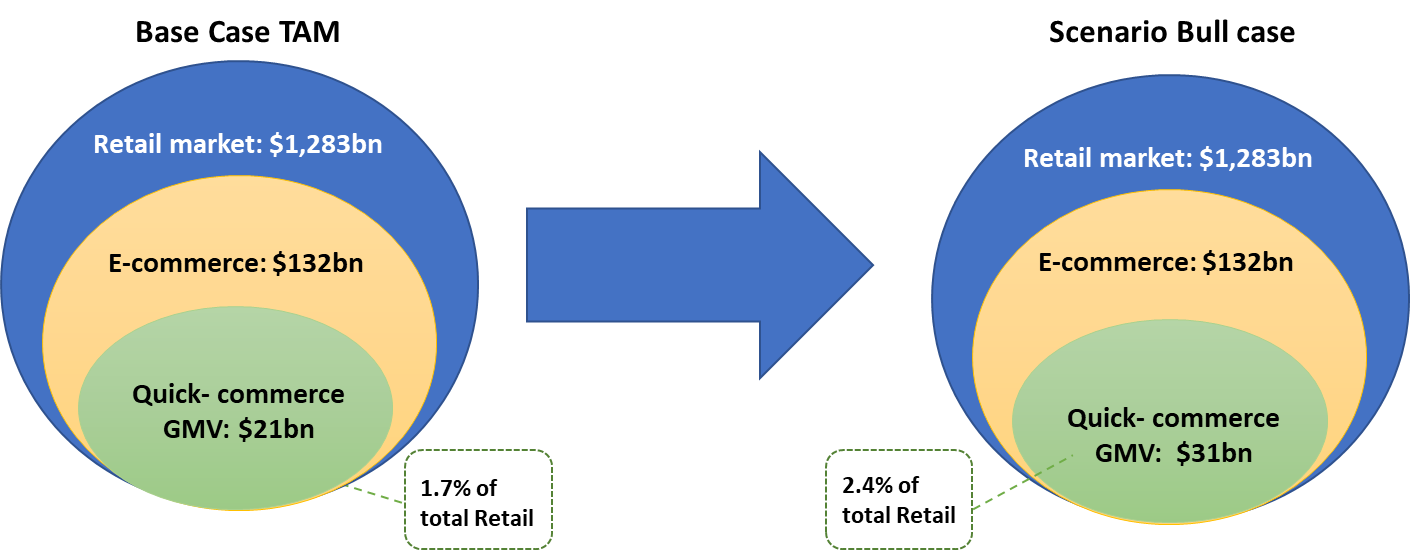

Looking at Akash Pandey's comprehensive report, I'm struck by how quick commerce isn't just growing - it's fundamentally changing consumer behavior. The numbers are staggering: the market is projected to reach $5.4 billion by 2025 and could explode to $40 billion by 2030. That's a 37% compound annual growth rate!

But what's really interesting is why this model works so well in India specifically. Our shopping patterns have always been different from the West. We've traditionally made frequent, small purchases at nearby kirana stores rather than weekly grocery hauls. Quick commerce essentially digitizes this behavior, making it even more convenient.

The dark store model is the secret sauce here. These are small 2,500-4,000 sq. ft warehouses strategically placed within 2-3 km of customers. They're not customer-facing but operate purely as mini fulfillment centers. Each dark store costs about ₹6-7 million to set up, but can save up to 23% on delivery costs compared to traditional models.

What surprises me is how quick commerce platforms can actually offer better pricing than traditional retail. By removing multiple middlemen between FMCG companies and consumers, they offset delivery costs while still maintaining competitive prices. No wonder 69% of online grocery shoppers prefer 10-minute delivery over next-day options.

Potential for quick commerce remains high: We believe quick commerce has permanently changed consumer behaviour in urban India. Consumers now demand most products at a much faster pace, and we believe the 10-15 min delivery service is here to stay.

Exhibit 7: Quick-commerce market is evolving on competition front

Currently in high competition phase: we expect competitive intensity to normalize over time

Almost all the survey respondents (95%) indicated that they compare prices across the quick-com platforms, with 61% always comparing prices and only 5% indicating that they stick to their favourite/go-to app without looking at prices.

Exhibit 12: : Dissecting geography-wise: Do you regularly use more than 1 app for quick commerce, if so, select the apps (Choose multiple options):

Per our survey results: Blinkit strong in North, East & Central India; Swiggy Instamart in South & Zepto in West India

As per BofA Global Research survey respondents data by geography: 1) North Indian users indicated Blinkit preferred app for 58% users vs 48%/44% using Zepto/Instamart; 2) In South, Instamart is the most preferred by half of the surveyed users, followed by Zepto & Blinkit; 3) In West India, the surveyed users indicated a close top 2 choice for Zepto & Blinkit being preferred by 57/55% users respectively; 4) Across East & Central India, the preference gap was wider between the user preference with 63%/57% users indicating their preference for Blinkit

The competition is fierce though. Blinkit (owned by Zomato) currently leads with about 54% market share, followed by Zepto (48%) and Swiggy Instamart (44%). Many users regularly switch between apps, with 61% always comparing prices before purchasing. Each platform has regional strengths - Blinkit dominates in North, East and Central India, while Swiggy Instamart is stronger in the South and Zepto performs well in Western states.

The real challenge is profitability. The sector is burning through an estimated ₹1,300-1,500 crore monthly as players compete for market dominance. Discount wars, high delivery costs, and inventory management all eat into margins. Yet companies are making progress through AI-driven supply chains, subscription models, and more efficient operations.

What's clear is that quick commerce is no longer just for emergency purchases. The report shows that 53% of users place more than 5 orders monthly, with 67% spending over ₹400 per order on average. It's becoming a primary shopping channel, not just a convenience option.

This shift is already impacting traditional retail. About 46% of quick commerce users have reduced purchases from kirana stores, with 5% stopping entirely. By 2024, an estimated $1.28 billion in sales is expected to transfer from kirana shops to quick commerce platforms.

The future looks promising with technology playing a crucial role. AI is helping predict demand patterns, optimize delivery routes, and manage inventory more efficiently. Subscription models are creating loyal customer bases. Sustainability initiatives like electric delivery vehicles are addressing environmental concerns.

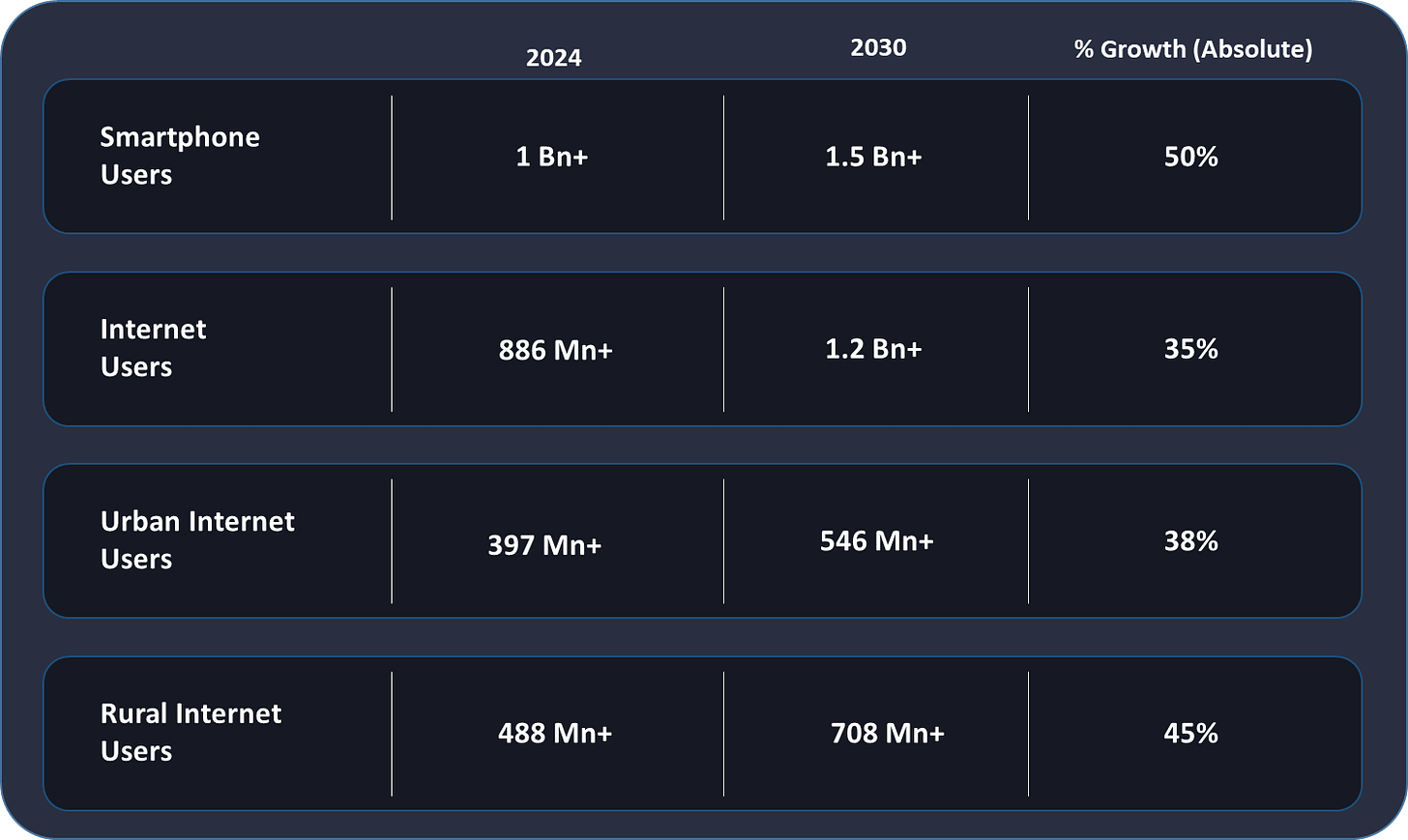

As internet penetration continues to grow (expected to reach 1.2 billion users by 2030), quick commerce will likely expand beyond urban centers. The current user base of 26.2 million is projected to more than double to 60.6 million by 2029.

What fascinates me most is how quick commerce represents India's unique path to retail modernisation. Rather than simply copying Western e-commerce models, we're creating something tailored to Indian consumer habits, infrastructure, and urban density.

Q commerce user penetration rate currently stands at 1.8% and is projected to rise to 4.0% by 2029.

This suggests that quick commerce is still in its early stages of development in India, but it is expected to grow rapidly in the coming years.

The quick commerce story is just beginning for investors, entrepreneurs, and consumers alike. The question isn't whether it will succeed, but who will emerge as long-term winners in this rapidly evolving market. The race for your doorbell is on, and it's happening in minutes, not days.

Signing off

The Valuation Story