Revenue Growth Story for Polycab India

About:

Polycab India Limited is a leading manufacturer of Cables and Wire and allied products such as uPVC conduits, lugs, and glands. We have cables and wires for practically every application. More recently, Polycab has also launched a wide range of consumer electrical products like Fans, Switches, Switchgear, LED lights and Luminaires, Solar Inverters, and Pumps.

What is the Revenue Mix of Polycab India Limited:

Revenue Mix Wire & Cable FMEG Others Polycab India‘s revenue comes from the Wire and Cable segment with 81% from Fast-Moving Electronic Goods with 8% and Others Especially from EPC Business. (As per FY 2023)

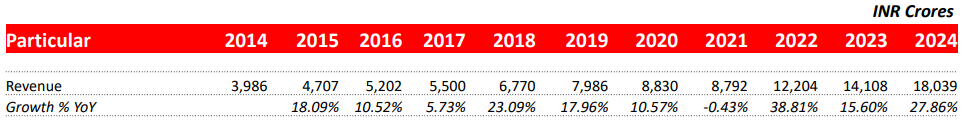

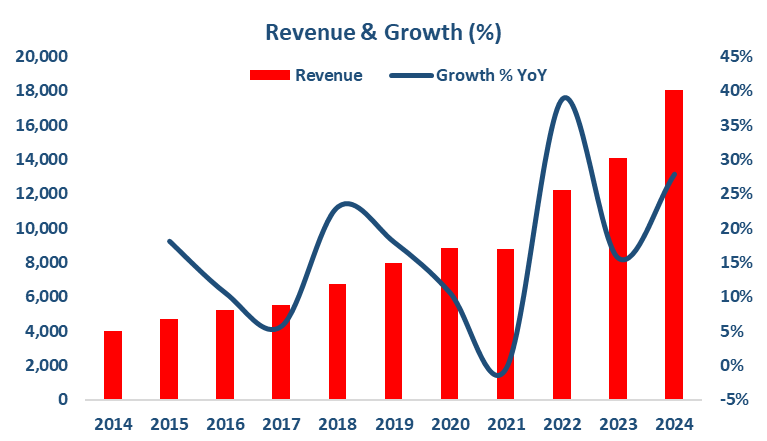

Revenue Analysis:

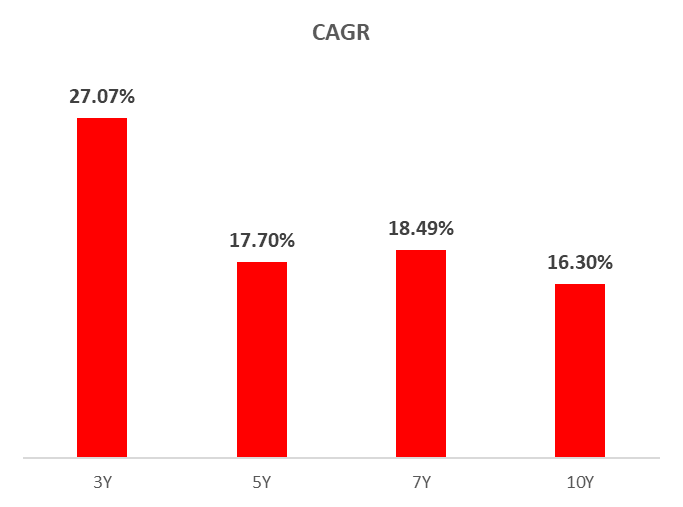

The Company has posted revenue of INR 18039.0 in CY2024, more than last CY2023 of 27.86%. The revenue has grown at a CAGR of 27.07%, 17.7%, 18.49% and 16.30% during the last 3, 5, 7 and 10 years respectively.

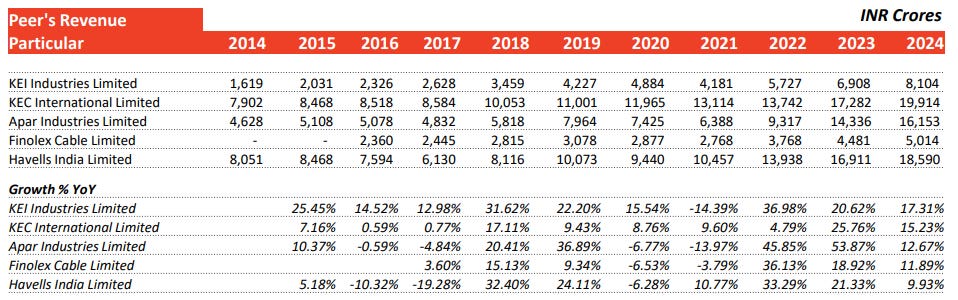

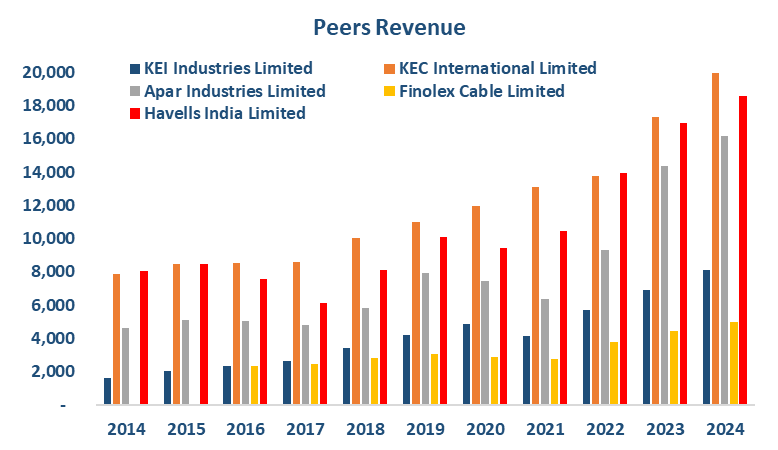

How have Polycab’s sales performed compared to its competitors?

The Company’s peers have posted revenue of Media of 13.41%. The revenue has grown at a Median CAGR of 21.90%, 13.04%, 17.17% and 9.68% during the last 3, 5, 7 and 10 years respectively.

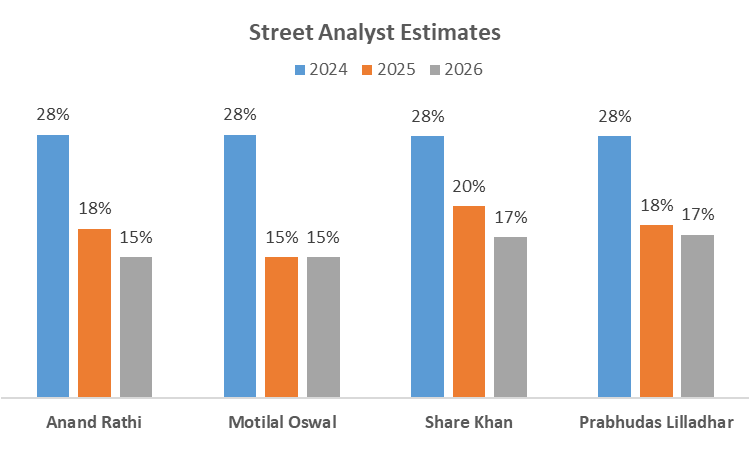

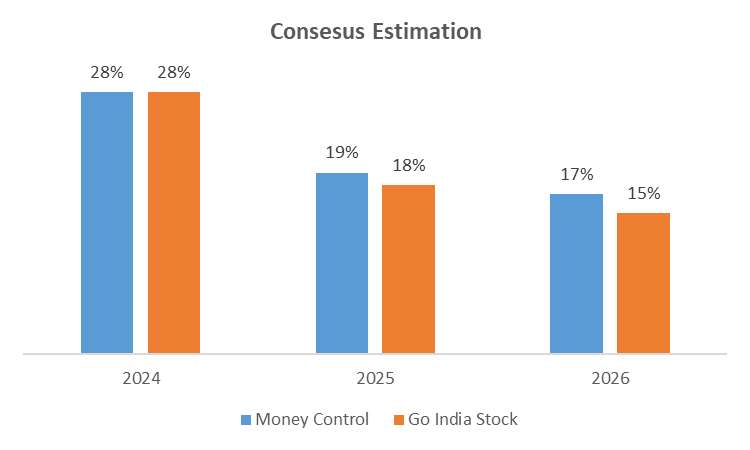

What is the Street Analyst and Consensus Estimation from the different sources?

The Analyst Consensus growth will increase to ~19% in FY 2024-25 and then will grow by 16% and Street analyst estimate that ~18% in FY 2024-25 and then will grow by 16%. As per this consensus estimate i assume the median of 19% by FY2024-25 and then will grow by 16% for the next.

What is the Sector and Industry Views:

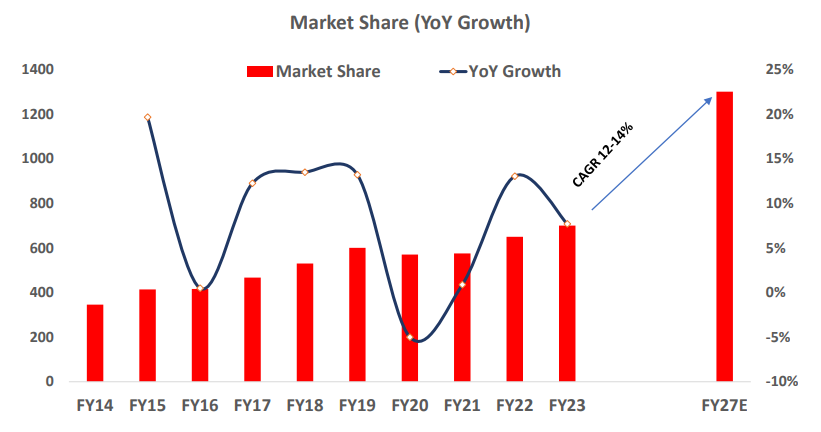

The cables & wires market reported ~8% CAGR over FY14-23 and it is estimated to clock 12-14% CAGR over FY23-27 (INR1.2-1.3t). Our analysed companies have seen a combined revenue CAGR of ~13% over this period, which should continue over FY23-26E. The share of branded players has increased to ~74% in FY23 from 61% in FY14 and is expected to improve to 80% by FY25.

Growth Story

Support of the Interim Budget 2024-25

Increased capital expenditure outlay by 11.1% to ` 11.1 lakh crore for FY 2024-25 for infrastructure development will boost the demand for wires and cables and other electrical products.

Increased allocation of ` 80,671 crores for PM Awas Yojana for the development of affordable housing in the country.

Allocation of ` 2.55 lakh crore for the Ministry of Railways, surpassing the previous year’s record of ` 2.4 lakh crore. Three major economic railway corridor programmes are identified under PM Gati Shakti.

Allocation for the Ministry of New and Renewable Energy (MNRE) increased by 25.7% to ₹ 128.5 billion in FY 2024-25.

Allocation of ` 600 crores for the National Green Hydrogen Mission and ` 8,500 crores for the development of solar power grid infrastructure.

The initiative ‘Pradhan Suryodaya Yojana’ (PMSY) aims to install rooftop solar power systems in one crore households, enabling them to obtain up to 300 units of free electricity each month.

Focus on expanding and strengthening the electric vehicle ecosystem by supporting manufacturing and charging infrastructure.

Allocation of ` 6,903 crore for semiconductor and display fabs to establish India as a global hub for chips and electronics manufacturing.

Increased outlay for the Production Linked Incentive (PLI) scheme by 33.5% to ` 6,200 crore will boost large-scale electronics manufacturing.

Improved electrification across the country

The government has implemented various schemes such as SAUBHAGYA, Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Ujjwal Discom Assurance Yojana (UDAY) and Integrated Power Development (IPDS) schemes to ensure uninterrupted power supply and achieve universal household electrification across the country. With an investment of ` 1.85 lakh crores under these schemes, 18,374 villages have been electrified and electricity connections have been provided to 2.86 crore households. These initiatives have resulted in improved power supply availability in both rural and urban regions. Energy consumption, covering both domestic and industrial usage, has surged rapidly, with energy requirements growing by 7.5% in FY 2023-24. Furthermore, increased investments in railway electrification and metro train initiatives have boosted energy demand. The increased demand for energy has driven the need for wires, cables, and other electrical products in the domestic market.

Export Promotion by Government

Government policies promoting exports provide significant support for RR Kabel’s international growth ambitions. By leveraging export incentives and favourable trade agreements, the Company can enhance its competitive edge in global markets.

EV Transition

With the Indian Government targeting 30% vehicle electrification by 2030 and implementing supportive policies such as the FAME India Scheme and PLI Scheme, the EV market is poised for rapid expansion. Additional initiatives like the Battery Swapping Policy and tax exemptions further stimulate EV adoption. Given the anticipated need for 20.5 Lakhs charging infrastructure installations by CY 2030, RR Kabel is well-positioned to capitalise on the EV transition in India.

Emphasis on renewable energy

The government’s focus on increasing the share of renewable energy in overall power generation is poised to accelerate the growth of the C&W industry. The government is actively promoting renewable energy through initiatives such as Inter-State Transmission System (ISTS) waiver, Renewable Purchase Obligation (RPO) trajectory until 2030, and Green Open Access Rules, among others. It is strengthening the transmission network to facilitate the effective integration of renewable sources. Furthermore, India is executing the world’s largest Solar and RE (renewable energy) park projects, including Bhadla Solar Park in Rajasthan and Khavda RE Park in Gujarat. As of 31st December 2023, 51 Solar Parks with an aggregate capacity of 37,740 MW have been sanctioned in 12 States, indicating promising opportunities for the C&W industry. Moreover, the initiative to install rooftop solar power systems in one crore households will bolster the demand for solar cables and wires. Additionally, the growing adoption of electric vehicles and the government’s focus on EV infrastructure and charging facilities will further drive the demand for cables and wires.

Urbanisation and expansion of the housing sector

Rapid urbanisation and surging housing demand are poised to fuel the demand for wires and cables. Government initiatives like the Smart Cities Mission, PMAY, NTR, DDA Housing Scheme, and AMRUT continue to drive growth in urban infrastructure and the housing sector, contributing to the expansion of the C&W industry. Furthermore, the allocation of ` 80,671 crore for the PMAY in the Interim Budget 2024- 25 is expected to bolster the housing sector and stimulate demand for wires and cables

Rapid infrastructure development

The government has allocated an increased capital expenditure of ` 11.11 lakh crore for FY 2024-25 in the Interim Budget 2024-25 for infrastructure development. The development of major railway corridors, new airports, railway modernisation, and expansion of the metro railway network are anticipated to create growth opportunities for the cable & wire industry. Furthermore, the National Infrastructure Pipeline (NIP) initiative has expanded to 9,288 projects with a total project outlay of ₹ 108.8 lakh crore between 2020-2025, with the energy sector accounting for 25% of the projected infrastructure investments under the NIP. Moreover, the government’s initiatives aimed at boosting domestic manufacturing and the industrial sector have paved the way for growth in the cable and wire industry.

Improved electrification across the country

The government has implemented various schemes such as SAUBHAGYA, Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Ujjwal Discom Assurance Yojana (UDAY) and Integrated Power Development (IPDS) schemes to ensure uninterrupted power supply and achieve universal household electrification across the country. With an investment of ` 1.85 lakh crores under these schemes, 18,374 villages have been electrified and electricity connections have been provided to 2.86 crore households. These initiatives have resulted in improved power supply availability in both rural and urban regions. Energy consumption, covering both domestic and industrial usage, has surged rapidly, with energy requirements growing by 7.5% in FY 2023-24. Furthermore, increased investments in railway electrification and metro train initiatives have boosted energy demand. The increased demand for energy has driven the need for wires, cables, and other electrical products in the domestic market.

The Fibre Optic Revolution

The rapid growth of data centers and the imminent 5G revolution is fuelling a significant boom in the fibre optic cable industry. India, in particular, is at the forefront of this technological advancement, with substantial investments being poured into the deployment of fibre optic networks. This strategic focus is poised to position India as a global leader in digital connectivity, driving significant economic growth and innovation. The increasing demand for cloud services and data storage is driving the need for high-speed, reliable connectivity. Fibre optic cables, with their ability to transmit vast amounts of data at incredible speeds, are the ideal solution to meet this demand. Additionally, the upcoming 5G networks, which promise to revolutionize various industries, will rely heavily on fibre optic infrastructure to deliver seamless connectivity and ultra-low latency. The Indian government's Digital India initiative is further accelerating the deployment of fibre optic networks across the country. This initiative aims to transform India into a digitally empowered society, and fibre optics play a crucial role in achieving this goal. By investing in this critical infrastructure, India can unlock the full potential of the digital age and create a more inclusive and prosperous society. The expansion of fibre optic networks is also generating significant job opportunities in various sectors, from manufacturing to installation and maintenance. This growth is attracting investments from both domestic and international players, fostering innovation and driving economic development. As India continues to embrace digital technologies, the role of fibre optics will only grow in importance. By investing in this critical infrastructure, we can connect the dots and build a brighter digital future.

Sources:-

PIB Press

Indian budget

Press Release

Economic times

Money Control

Thank You for Reading

Growth Inshots