The Battery Gold Rush: Where Smart Money is Really Going

Weekly Insights for Finance Professionals

Hi readers,

Welcome to another edition of The Valuation School.

The battery market is huge. We're talking about a business worth hundreds of billions of dollars. But here's what most people miss: the real money isn't where you think it is. Everyone wants to invest in the next big EV company. But the smart money is looking deeper into the supply chain. That's where the real profits are hiding.

Today, I'm going to show you exactly where smart money is positioning itself, and why the biggest opportunities in the EV revolution have nothing to do with the cars themselves.

Where The Money Really Lives

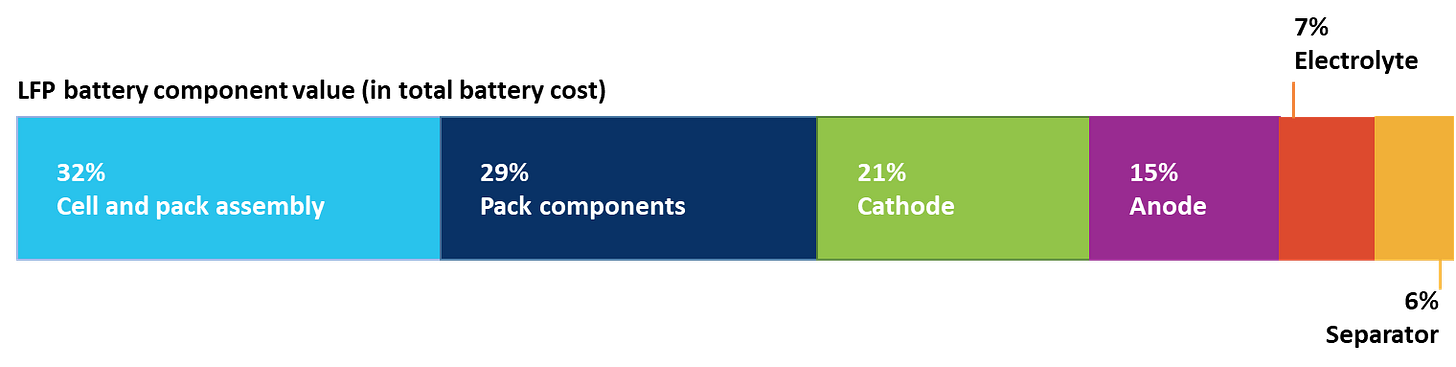

Let me break this down for you. When you buy a battery, what are you actually paying for?

Most people think it's all about the fancy materials inside. The lithium, the nickel, the cobalt. But look at the numbers. In LFP batteries, which are the cheaper ones that most people will buy, the biggest cost is putting the whole thing together. We're talking about 32% of the total cost just for assembly and packaging.

Think about it like building a house. Everyone focuses on the expensive marble countertops, but the real cost is in the construction work. Same thing here.

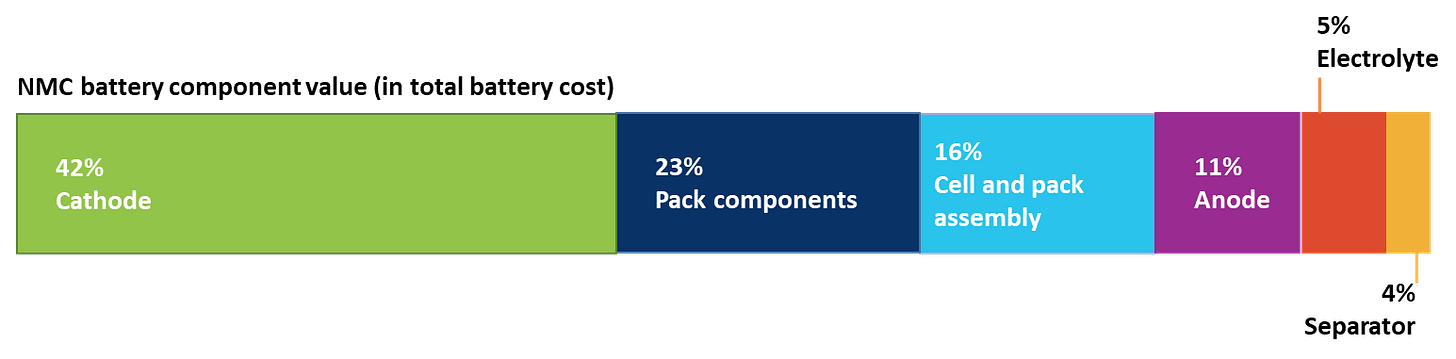

Now compare that to the premium NMC batteries. These are the ones that go into expensive cars. Here, the cathode materials eat up 42% of the cost. That's the expensive stuff everyone talks about.

Tells us something important. If you're investing in the mass market, you want companies that are really good at putting batteries together efficiently. If you're betting on the premium market, you need to understand materials and supply chains.

The China Problem

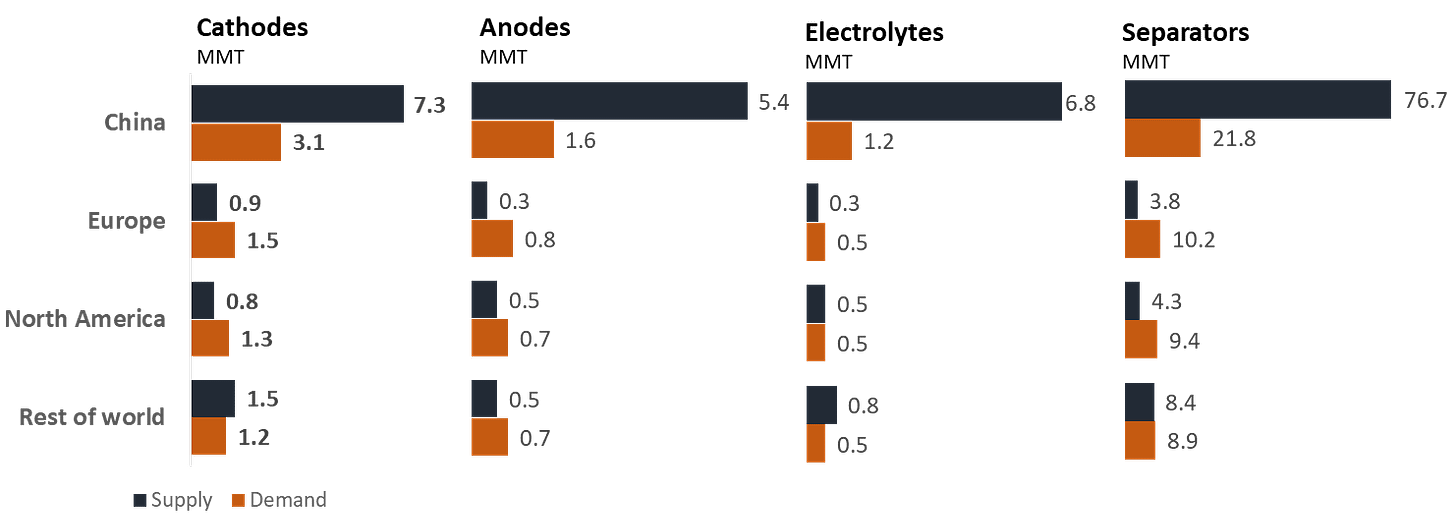

Here's where it gets interesting. China doesn't just make a lot of batteries. They control almost everything that goes into making batteries.

Look at India as an example. When Indian companies need to import battery materials, they mostly buy from China. Not just sometimes. Mostly. For cathodes, separators, and electrolytes, China is basically the only game in town.

By 2030, China will have enough separator production capacity to supply the entire world almost four times over. That's not an accident. That's strategy.

This creates two big opportunities.

First, any company that can make these materials outside of China will have customers willing to pay extra for supply security.

Second, anyone betting on Chinese companies needs to understand they're also betting on Chinese government policy.

The Lithium Story Everyone Gets Wrong

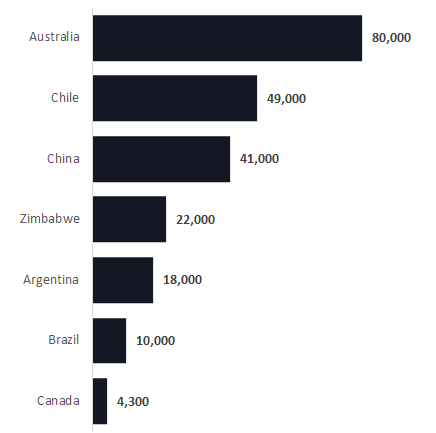

Australia produces 80,000 metric tons of lithium. Chile produces 49,000 metric tons. China produces 41,000 metric tons. Most people see these numbers and think Australia is winning.

But here's what they miss. Digging lithium out of the ground is one business. Turning that lithium into battery-grade materials is a completely different business. China dominates the second part, even when they don't own the mines.

India just discovered 5.9 million tonnes of lithium resources in Kashmir. That sounds huge, but remember, finding lithium and processing lithium are different games with different rules and different profit margins.

Three Ways To Make Money

Based on all this data, I see three clear opportunities.

The first opportunity is in assembly and manufacturing. Companies that can put batteries together efficiently and at scale will make good money as the market grows. This is especially true for the mass market, where cost matters more than fancy features.

The second opportunity is in building alternatives to Chinese supply chains. Any company that can make battery materials outside of China will find customers willing to pay premium prices. The geopolitical risk is real, and smart companies are willing to pay for supply security.

The third opportunity is in processing and refining. There's a big gap between owning lithium resources and turning them into usable materials. Companies that can bridge this gap, especially in stable countries with good regulations, will create real value.

What Could Go Wrong

The battery industry is changing fast. Lithium mining is expected to grow at 7.2% per year through 2035, but that growth has to match up with demand. If demand slows down or speeds up unexpectedly, there will be winners and losers.

The bigger risk is supply chain disruption. When one country controls most of the supply chain, any political problem becomes an economic problem. Smart investors need to price this risk into their calculations.

The companies that understand cost structures, manage supply chain risks, and position themselves in the right part of the value chain will generate the best returns. Batteries are becoming a commodity, but battery supply chains are becoming strategic assets.

The data shows us where to look. Now it's up to smart investors to act on it.

thank you for reading

Akash…

This analysis uses 2024 industry data. Battery markets move fast, so always do your own research before making investment decisions. This is just for educational purpose not for investment.