The Battery Report: What's Charging the EV Revolution

Hi readers,

Welcome to another edition of The Valuation Story.

Today, we will discuss how the EV battery makes a significant impact on Electric Vehicles.

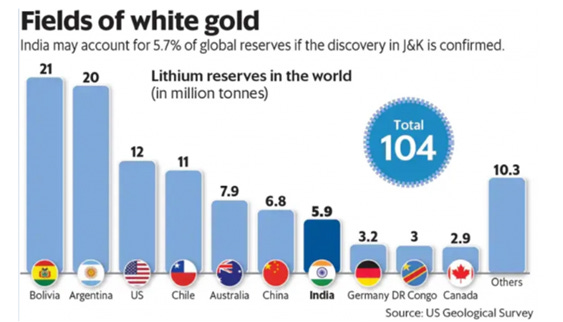

Almost 30-40% of the Electric Vehicle cost is for the Battery cost. We don’t have any raw materials which is used in battery like - Lithium, Cobalt, Manganese, Graphite and Nickel.

Lithium is a key material used in EV Batteries. India does not produce lithium and depends on imports for lithium batteries. We are relying on China, Chile, Bolivia, Argentina and Australia because these countries have a lot of lithium reserves.

The Geological Survey of India (GSI) has established 5.9 million tonnes of inferred lithium resources in the Salal-Haimana Area of Raesi District in Jammu & Kashmir. Lithium is considered a strategic element because of its use in batteries used in EVs.

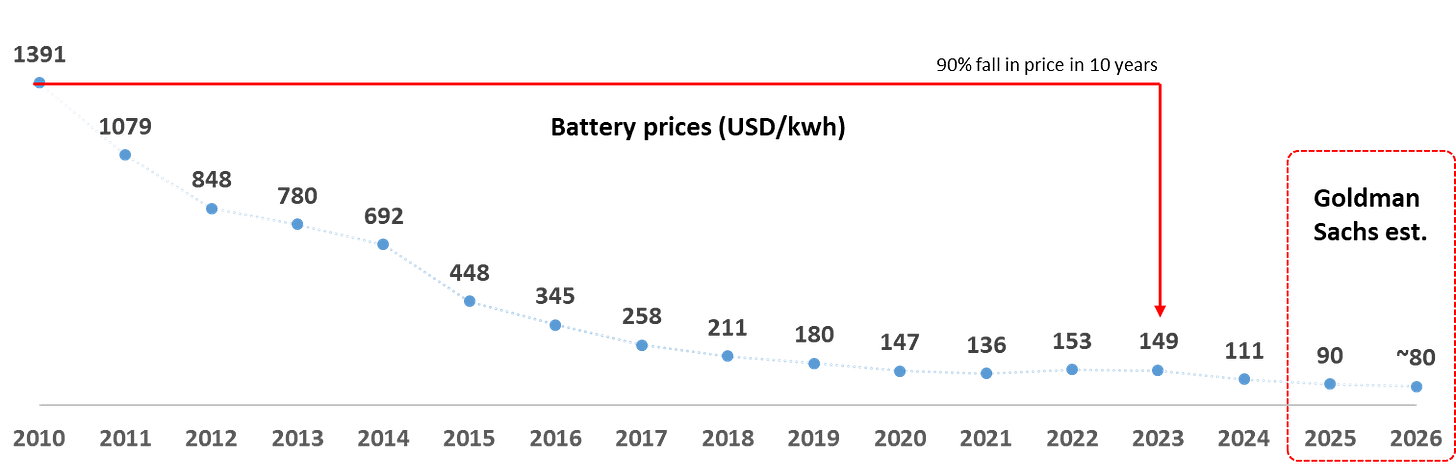

Electric Vehicle battery prices are expected to fall almost 50% by 2026 to $ ~80 per kWh. It happened because the price of Lithium and other raw materials has dropped due to better mining and logistics. Lower material costs are making EV batteries and cars cheaper to produce.

Oversupply in Production: China is producing more batteries than needed, covering 92% of global demand. This oversupply is pushing battery prices down.

Falling Material Costs: Prices of lithium, cobalt, and nickel have dropped due to better mining and logistics. Lower material costs are making EV batteries and cars cheaper to produce.

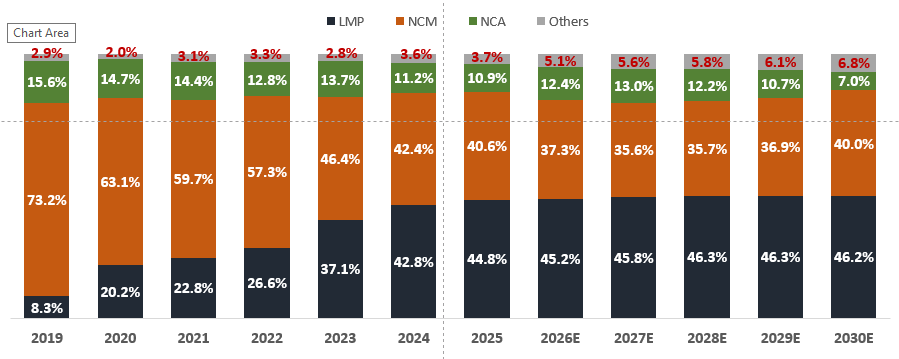

Rise of LFP Batteries: Automakers are shifting to Lithium Iron Phosphate (LFP) batteries for cost and safety. Though lower in energy density, LFPs are affordable, stable, and gaining massive adoption.

Automakers are shifting to Lithium Iron Phosphate (LFP) batteries for cost and safety. Though lower in energy density, LFPs are affordable, stable, and gaining massive adoption.

Both the leading battery types are lithium-based. One is based on nickel chemistry, which dominates nearly 60% of the market for different types of nickel batteries. And the other leading type – LFP (lithium ferrophosphate) – is iron-based. They’re capturing about 40-47% of the market. Then there is a very small share coming from another technology called sodium ion. It’s the only non-lithium battery, but a very small quantity of such batteries are being produced today, and it’s not scaled up yet.

China has been processing the largest volumes of NMC and LFP chemistry components, solidifying its dominance in this sector

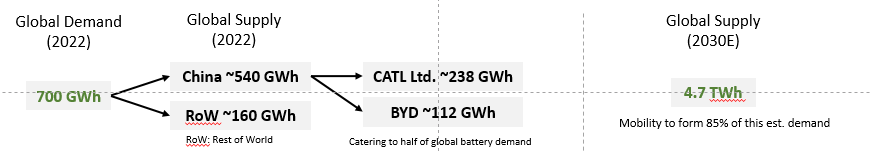

The global demand for EV batteries in 2022 was 700 GWh, where China was supplied ~540 GWh and the rest of the world supplied ~160 GWh. Now, based on the report from BDO India Publication 2025, by 2030, Global demand will increase to ~4.7 TWh.

As per BDO India Publication 2025, China has maintained almost ~77% of global production because of a large amount of raw materials, and chain and the capacity to produce batteries. China is producing almost 6 out of 10 batteries globally.

Considering the report from BDO India Publication 2025, India’s EV battery demand in 2022 was 13.6 GWh. Now, based on my research, that a heavy growth in the EV sector in India, with almost 2.1x growth till 2029 from 2025 as per other sources.

Please share your thoughts on it for the battery market in India and consumption in India.

Singing off

The Valuation Story