Hey readers,

Welcome to another weekly edition of The Valuation Story.

Today we will discuss the merger & Acquisition of Zomato and Blinkit.

You know those moments when you're scrolling through two different apps – ordering dinner on one and groceries on another – and you think, "Why am I doing this separately?"

That's exactly the insight that led to one of the most fascinating business combinations I've analyzed in recent years.

I've been following the Zomato-Blinkit story since the merger was announced, and today I want to share my thoughts on why this partnership matters beyond the headlines and what it teaches us about valuation in the evolving digital economy.

Two Stories Becoming One

I remember when Zomato was just a place where my friends and I would check restaurant reviews before deciding where to eat out. Founded in 2008, it began as a simple restaurant discovery platform.

Like many of you, I watched as it evolved from a digital menu card to the app I now open almost reflexively when hunger strikes but cooking feels impossible.

On the other side was Blinkit (formerly Grofers), which caught my attention during the pandemic when venturing to grocery stores suddenly felt risky. What started as a convenient grocery delivery service transformed into something more ambitious – the promise that almost anything I might need could arrive at my doorstep in just 10 minutes.

I've often thought about these two services as solving different problems in my life. But the leadership teams at both companies recognized something I hadn't: they weren't operating in different spaces at all. They were addressing different moments in the same customer journey – mine and yours.

Why This Marriage Made Sense to Me

When the $570 million acquisition was announced in June 2022, I immediately started digging into the strategic rationale. Beyond the financial headlines, three things stood out to me:

We're All Running Out of Time

I don't know about you, but between deadlines for this blog, family commitments, and trying to maintain some semblance of a social life, time has become my most precious resource. I've noticed myself increasingly willing to pay a premium not for luxuries, but for time saved.

The behavioural data supports this. In conversations with friends working at both companies (over coffee that I ordered for delivery, naturally), I heard that customers were frequently switching between the apps multiple times in a single day. We were creating unnecessary friction in our own lives by treating food delivery and grocery shopping as separate mental categories.

The Economics Made Too Much Sense

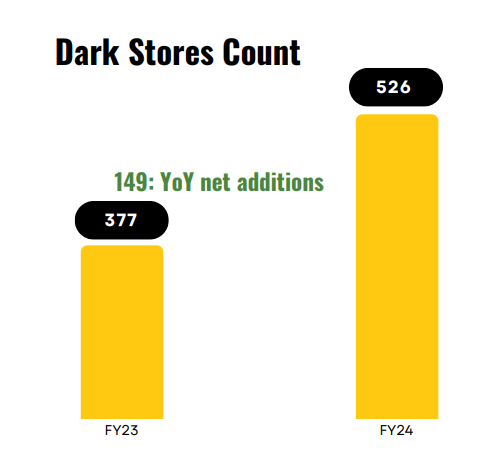

As someone who analyzes business models for a living, the economic synergies jumped out immediately. Both companies had built sophisticated logistics networks that were idle at different times. Both had invested in hyperlocal presence – Zomato with restaurant partnerships and cloud kitchens, Blinkit with dark stores.

I sketched out the overlap of these networks on a napkin during one of those coffee conversations, and the inefficiency of keeping them separate became obvious. It reminded me of two airlines flying half-empty planes along the same routes at the same time.

The Data Story Was the Clincher

Here's where my analyst brain gets really excited. When I started mapping out the potential insights from combining these data streams, the possibilities were staggering.

Think about it – Zomato knows what prepared foods you enjoy, while Blinkit knows what ingredients you buy. Together, they can understand not just what you consume, but how you make decisions about consumption. Do you buy ingredients with aspirations to cook, but end up ordering in? Do your grocery purchases predict your restaurant choices? These aren't just interesting questions – they're the foundation of anticipatory commerce.

Growing Pains I've Observed

Being in Bangalore, I've had a front-row seat to watching this integration unfold. I've chatted with delivery partners who suddenly found themselves carrying both restaurant meals and grocery packages. I've spoken with product managers wrestling with how to merge distinct user experiences without confusing loyal customers.

The journey hasn't been without its bumps. Cultural integration never is. One engineer told me over a beer that the early days felt like "two families moving in together and arguing about where to put the furniture." The Blinkit team had developed precision systems for inventory management where accuracy was non-negotiable. The Zomato culture had optimized for restaurant relationships and food quality control – equally important but requiring different skills.

I've also watched the consumer education challenge play out in real time. My mother, a devoted Zomato user, was initially confused about why grocery promotions were appearing in what she considered her "food app." This mental recategorization takes time.

What This Tells Us About Valuation

For us valuation nerds (and I count myself firmly in that camp), this merger offers a fascinating case study. Traditionally, we've valued these businesses differently:

Food delivery companies typically commanded multiples based on GMV, with investors focusing on order frequency and average order value.

Quick commerce players like Blinkit were often valued based on revenue multiples or even the economics of individual dark stores, with metrics like sales per square foot borrowed from traditional retail.

But what happens when these categories blur? How do we value a business that isn't just increasing its TAM by adding adjacent categories, but is fundamentally deepening its relationship with the same customer base?

I'm increasingly convinced that customer lifetime value becomes the dominant metric in these cross-category platforms. The question isn't just "How much does the average customer spend on food delivery?" but "How much of a customer's total consumption can we capture across categories?" This aligns with what Deepinder Goyal himself highlighted in Zomato's quarterly reports about the importance of deepening customer relationships2.

This represents a fundamental shift in how we should think about valuing digital consumer businesses. It's not just about category dominance – it's about journey comprehensiveness.

What I'm Watching Next

As I continue to track this story, here are the developments I'm particularly interested in:

Beyond Food and Groceries

The obvious next frontier is pharmacy delivery, which follows the same hyperlocal, time-sensitive pattern. But I'm more intrigued by what happens when the combined entity starts leveraging its data to move beyond delivery altogether.

Could they start offering meal planning services that bridge both prepared food and groceries? Might they expand into subscription offerings that anticipate regular needs? Could they partner with appliance makers to create smart kitchens that know when you're running low on essentials?

From Reactive to Predictive

The most valuable evolution, in my view, would be the shift from on-demand to anticipatory commerce. I'd love to see features that don't just respond to my immediate needs but help me plan for future ones.

Imagine if the app knew that I typically order pizza on Friday nights, but also noticed that I've been buying more health-conscious groceries lately. It might suggest a cauliflower crust option or recommend a healthy restaurant that I haven't tried yet.

The Network Effect Amplifier

What makes this combination particularly powerful is how it amplifies network effects. Each new dark store or restaurant partner improves delivery economics for both businesses. Each new customer makes the combined data set more valuable. Each new category expansion increases switching costs for users.

This creates a flywheel that could be difficult for competitors to match unless they pursue similar cross-category strategies.

Lessons for Other Businesses

As I reflect on this merger, I see several lessons that apply beyond food and grocery delivery:

Look for behavioural adjacencies, not just category adjacencies. What else do your customers do immediately before or after using your product?

Data integration creates more value than operational integration. While cost savings from shared operations are real, the strategic advantage comes from the combined understanding of customer patterns.

The customer experience must remain intuitive even as the business complexity increases. Success depends on making the combined offering feel natural, not like two separate services awkwardly stitched together.

Think in terms of customer moments, not product categories. The most successful innovations come from identifying specific moments in customer lives where a combined entity can create unique value.

Cultural integration deserves as much attention as business integration. Teams that succeed in working across former company boundaries are those that develop shared rituals and values.

Why I'm Optimistic

Despite the challenges, I remain optimistic about this combination for one simple reason:

it aligns business structure with actual human behaviour. None of us mentally separate our consumption into rigid categories like "restaurant food" and "grocery items." We simply have needs throughout the day and look for the most effortless way to fulfil them.

In bringing together Zomato and Blinkit, the leadership teams aren't just expanding their addressable market—they're aligning their business with how we live. And that alignment, more than any other factor, is what creates lasting value. The post-merger performance seems to validate this approach, with Blinkit's gross order value growing at over 100% year-on-year according to Zomato's financial reporting.

I'd love to hear your thoughts on this merger. Have you noticed changes in how you use these services since they combined?

Are there other category combinations you think would make sense in the digital consumption space?

Drop your comments below or reach out – these conversations are what make writing The Valuation Story so rewarding.

Until next time,

Akash

The Valuation Story brings you insights into the strategic moves reshaping business landscapes. Follow us for more analysis on the deals defining tomorrow's market leaders.

Sources:

Money Control, Management Enthusiast, NSE, Jagran Josh, Live mint

Read more: