Why Are India and the U.S. Moving in Opposite Directions on Bond Yields?

What is the 10Y Bond Yield of a Country?

Imagine lending your money to the government for 10 years. In return, the government promises to pay you interest every year and return your original money at the end of the 10 years.

These bonds are a safe way for businesses to invest and earn steady returns over time. The interest rate, or yield, on the bond shows how much money you’ll make from it.

Here’s the interesting part: Even though the bond’s interest rate is fixed when you buy it, the yield can change. The yield depends on how much people are willing to pay for the bond in the market. If many people want to buy it, the price goes up, and the yield goes down. If fewer people are interested, the price goes down and the yield goes up.

In short, 10-year bonds are a way for businesses and investors to earn predictable, low-risk returns by lending money to the government. However, the yield can change depending on the market.

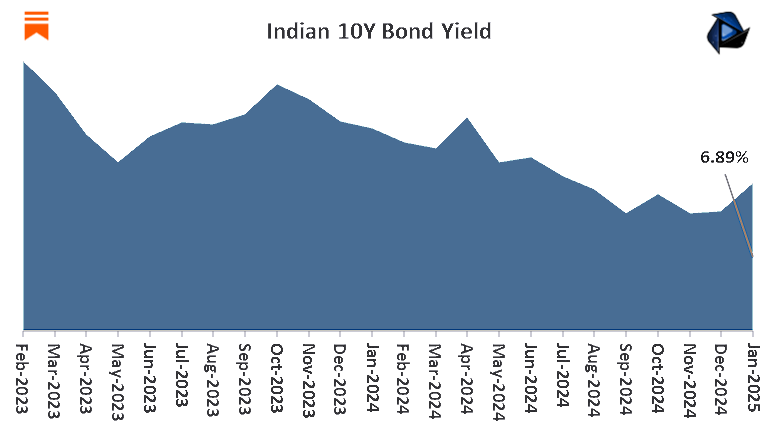

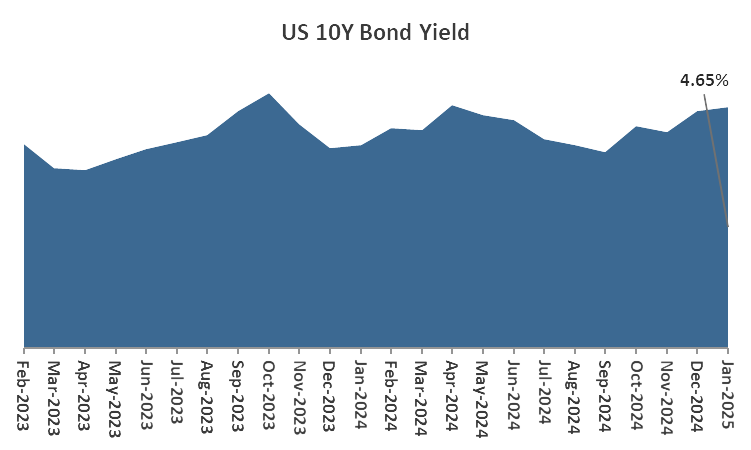

Bond Yields in India vs. the United States

As of January 15, 2025, India’s 10-year government bond yield stands at 6.85%, while the U.S. yield is at 4.66%. This difference between the two yields tells us a lot about the economic and market conditions in both countries.

In India, inflation is a big concern, especially with rising food and fuel prices. When inflation is high, investors expect the Reserve Bank of India to raise interest rates to control it. While higher interest rates make borrowing costlier, they also result in higher returns on government bonds, which pushes bond yields up. Also, if the government needs to borrow more money, it issues more bonds. With more bonds in the market, investors demand higher yields.

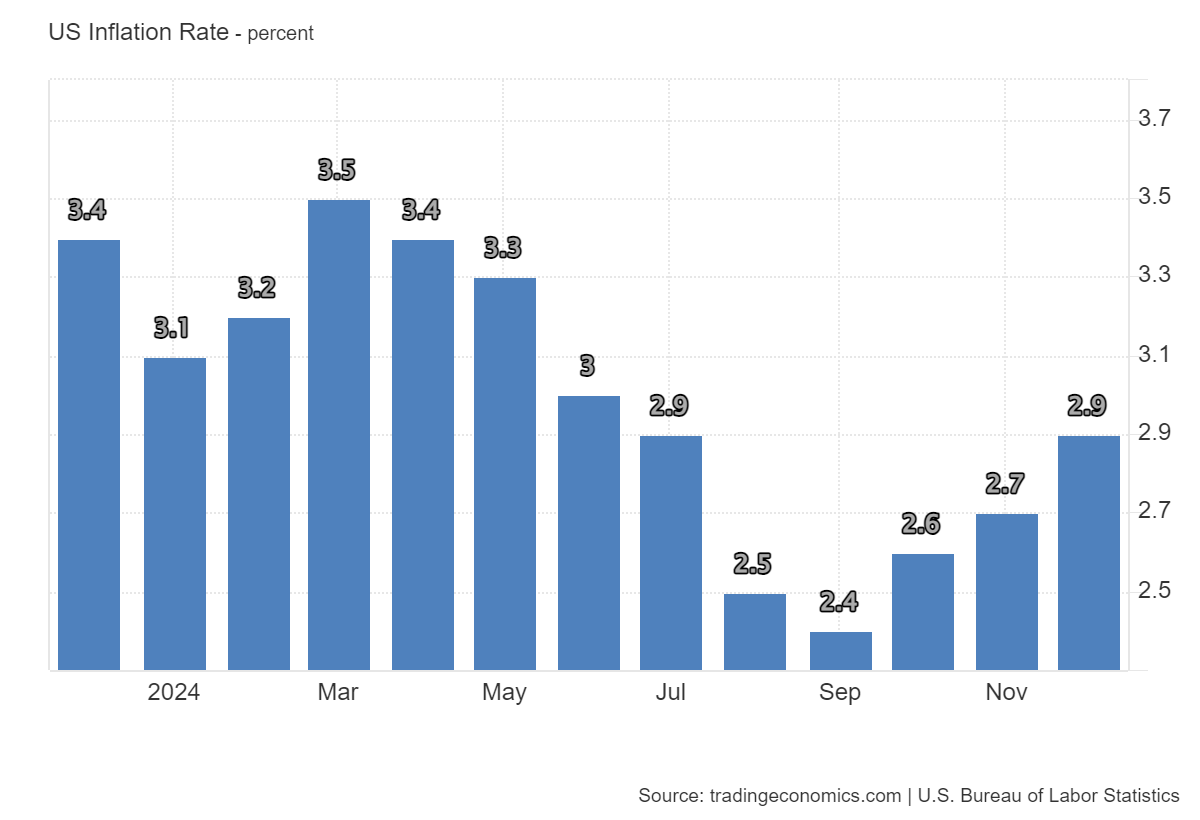

In the U.S., the story is different. Inflation seems to be cooling off, and the Federal Reserve is considering lowering interest rates. Lower interest rates make bonds more attractive, leading to higher demand. When more people buy bonds, the price goes up, and the yield goes down.

Global factors also play a role. U.S. Treasury bonds are seen as one of the safest investments. During times of uncertainty, investors often move their money into these bonds, increasing demand and lowering yields. On the other hand, Indian bonds, being part of an emerging market, carry more risk. If global investors feel cautious, they may reduce their investments in Indian bonds, causing yields to rise.

These differences in bond yields highlight the unique economic situations in India and the U.S. While India deals with inflation and government borrowing, the U.S. focuses on managing its growth and stabilizing the economy. It also shows how global financial markets are connected.

Thanks for reading Growth Inshots!

Subscribe for free to receive new posts and support my work.