Why India's $16 Billion EV Battery Market Could Make You Rich by 2030

Unpacking the hype: What's driving investment—and what's missing from the equation.

Hello readers,

Welcome to another edition of The Valuation Story.

I'm Akash, and today I want to share something that's been keeping me up at night: the battery story that could make or break India's electric dreams.

Note: This is just for educational purposes not for any recomendations

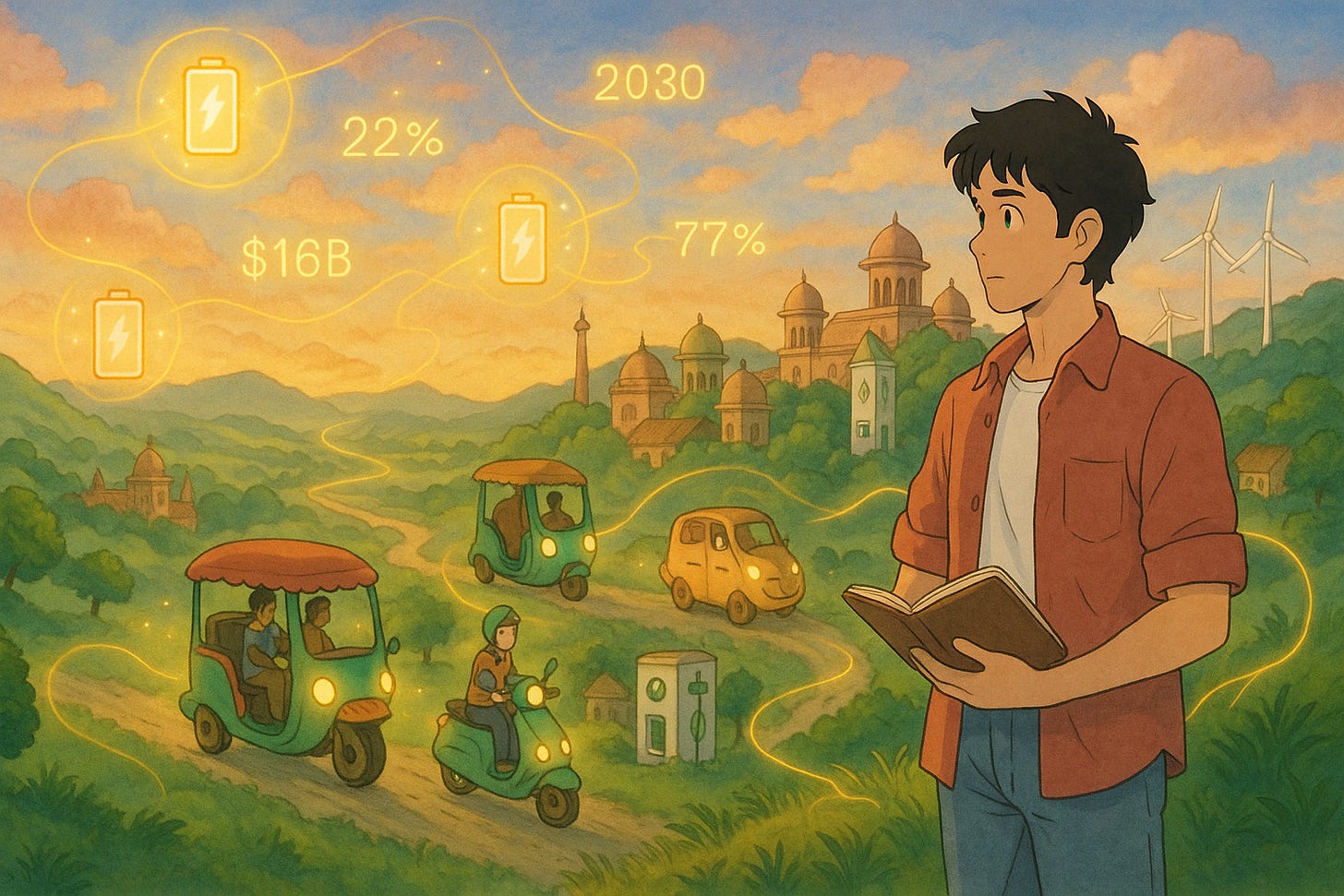

This One Component Costs 40% of Every EV in India

Every electric vehicle rolling down Indian roads carries a secret burden. Nearly 40% of its entire cost comes from just one component—the battery. Think about that for a moment. When you buy a ₹1.5 lakh electric scooter, ₹60,000 of that goes straight to the battery pack. And here's the kicker: we're importing almost all of these batteries, making us completely dependent on global supply chains and their associated price fluctuations.

This isn't just about cost—it's about control. Without solving the battery puzzle, India's electric vehicle dreams remain at the mercy of external forces.

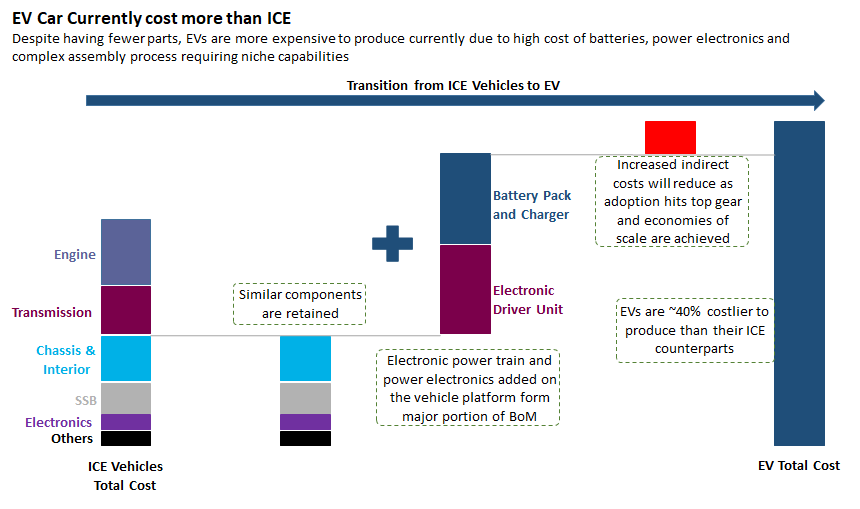

From 7.9% to 30%: The Insane Growth That Will Create Millionaires

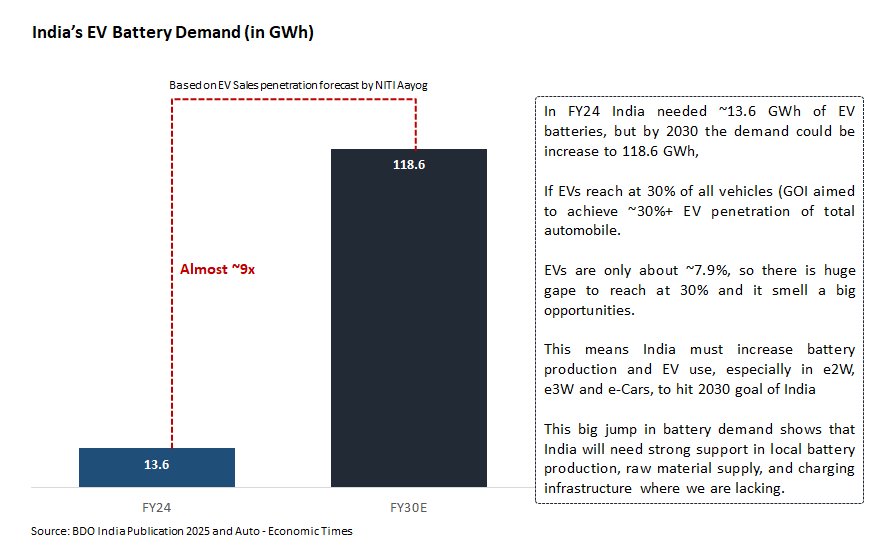

The transformation happening around us is staggering. Today, electric vehicles make up just 7.9% of total automobile sales in India. But we're targeting 30% by 2030. That's not just growth—that's a complete reimagining of how India moves.

The battery market is responding in kind. From $5.78 billion in 2025, we're looking at $16.09 billion by 2030—a compound annual growth rate of 22%. To put this in perspective, that's like the entire market nearly tripling in just five years.

But here's where it gets interesting. Our battery demand stood at 13.6 GWh in FY24. By 2030? We'll need 118.6 GWh. That's nearly nine times more battery capacity in six years. The scale of this challenge is breathtaking.

LFP vs NMC

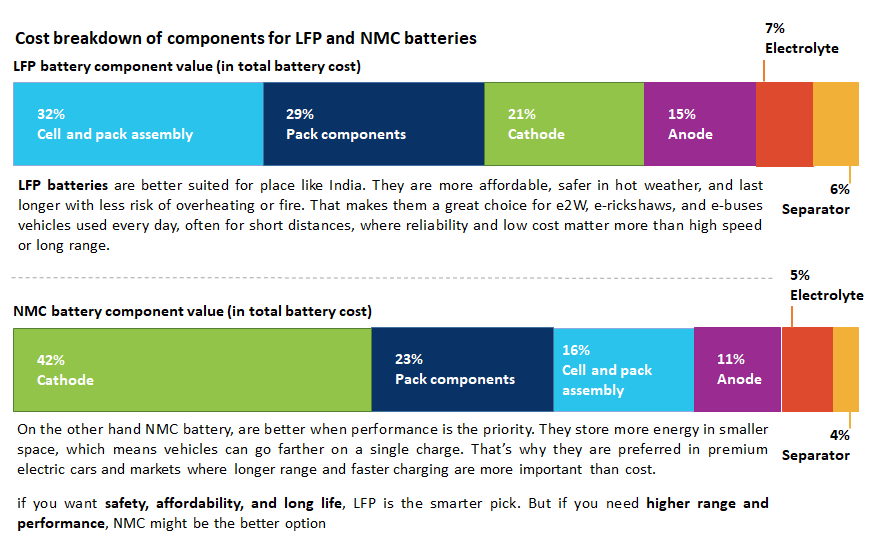

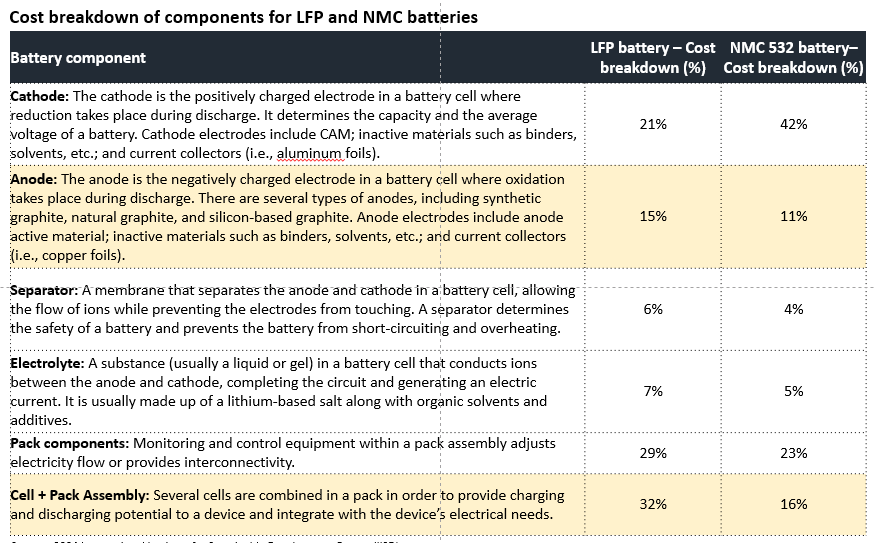

Walk into any electric vehicle showroom today, and you'll encounter two types of batteries, each telling a different story about India's electric future.

LFP batteries—Lithium Iron Phosphate—are the workhorses of our electric revolution. They're cheaper, handle India's heat better, and last longer. Perfect for the millions of delivery boys weaving through traffic on electric scooters, the auto-rickshaw drivers making short city runs, and the buses carrying office workers on their daily commutes.

Then there's NMC—Nickel Manganese Cobalt. More expensive, yes, but offering the range and quick charging that premium car buyers demand. These batteries power the luxury electric vehicles that are slowly but surely changing perceptions about what electric mobility can offer

.The choice between these isn't just technical—it's strategic. LFP gives us affordability and reliability for mass adoption. NMC gives us the performance needed to compete with conventional luxury vehicles.

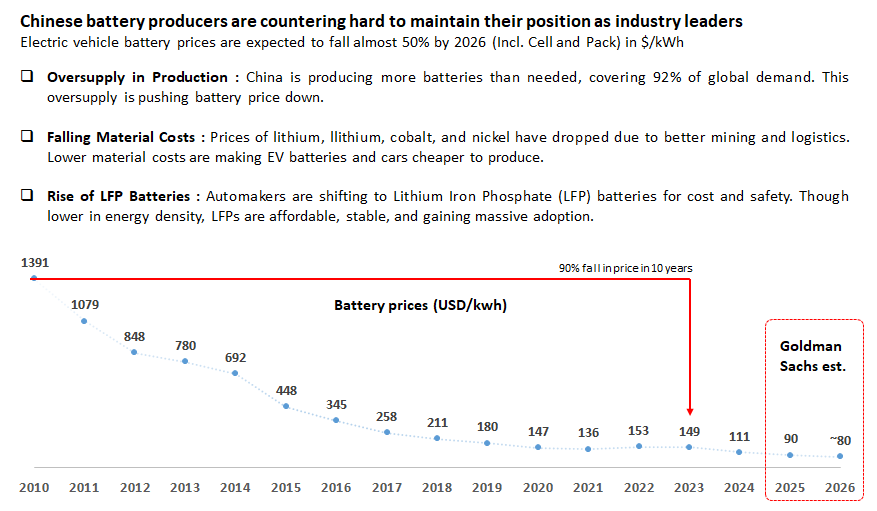

Battery Prices Crashed 90% - Here's What Happens Next

Something remarkable has happened over the past decade that most people have missed. Battery prices have crashed by nearly 90%. Bloomberg NEF predicts they'll hit $80-90 per kWh by 2025-26. This isn't just a cost reduction—it's the key that unlocks mass adoption.

When battery costs drop, electric vehicles become competitive with conventional vehicles. When that happens, the entire market dynamic shifts from early adopters to mainstream buyers. We're standing at that inflection point right now.

China Controls 77% of Global EV Batteries - India's Response Will Shock You

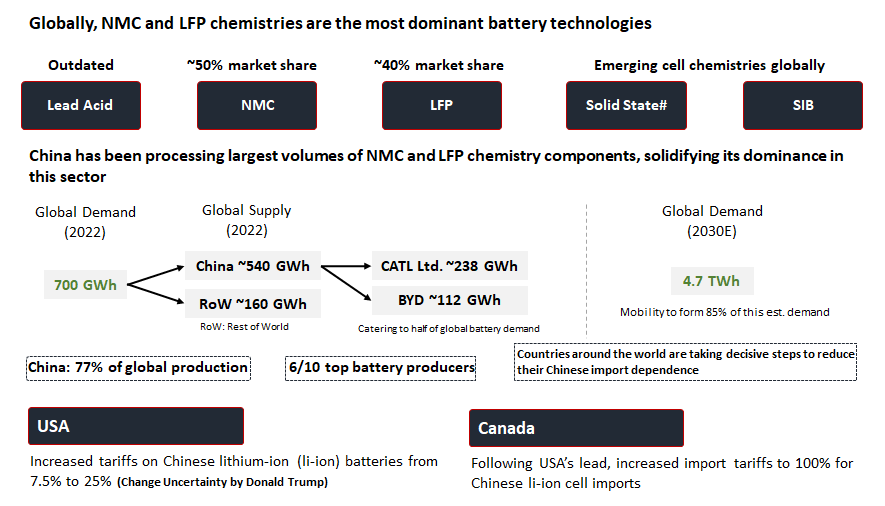

But here's the uncomfortable truth: China controls 77% of the global battery supply chain. Six out of every ten EV batteries rolling off production lines worldwide come from Chinese factories. For India, this creates a strategic vulnerability that goes far beyond simple economics.

Our dependence on imported lithium, cobalt, and nickel means we're exposed to price shocks and geopolitical risks. One supply chain disruption, one trade dispute, and our electric vehicle dreams could face serious headwinds.

These Indian Companies Are Betting Billions on Battery Manufacturing

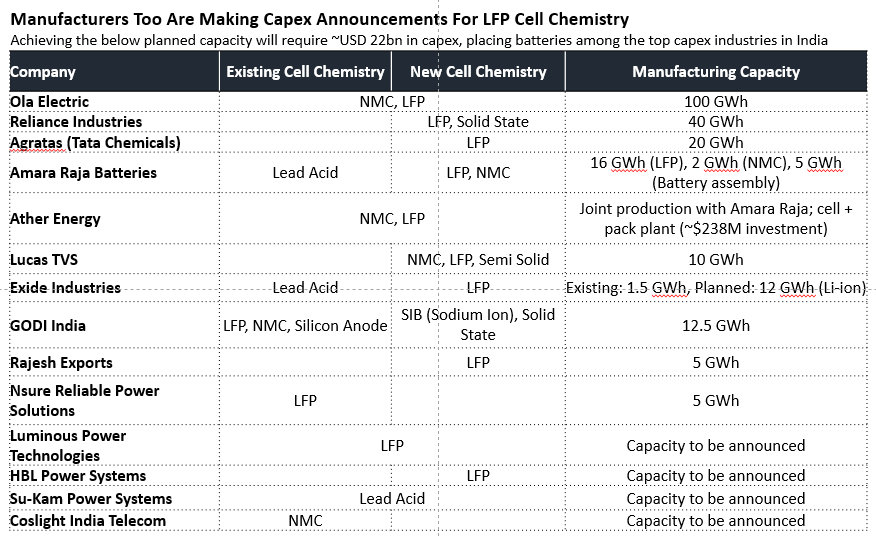

Recognizing these challenges, the Indian government has placed significant bets through FAME-II and PLI schemes. These aren't just policy initiatives—they're strategic investments in India's electric future. The goal is clear: reduce import dependence while building domestic manufacturing capabilities.

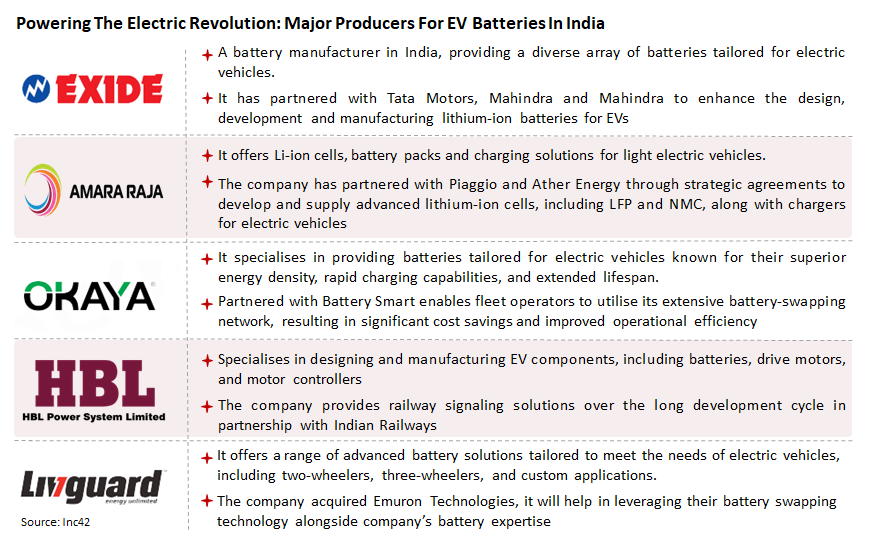

This government support is already attracting serious players. Companies like OLA Electric, Reliance, Ather Energy, Exide, and Amara Raja Batteries are pouring resources into local battery manufacturing. Startups are emerging with innovative solutions. The ecosystem is taking shape.

The $16 Billion Question: Will India Win or Lose the EV Battery War?

So, where does this leave us? The opportunity is massive—a $16 billion market by 2030. The challenge is equally significant—building cost-effective, locally produced battery cells while scaling up raw material supply and charging infrastructure.

The real insight here isn't just about the numbers. It's about understanding that India's electric vehicle success hinges on solving the battery equation. LFP chemistry offers us a clear path forward due to its affordability and thermal stability. But to meet our 2030 goals, solving the battery cost and supply issue isn't optional—it's foundational.

The transformation is already underway. The question isn't whether India will embrace electric mobility, but whether we'll control our destiny in making it happen.

Singing off

The Valuation Story

What are your thoughts on India's battery strategy? Are we moving fast enough to build true energy independence?

This is The Valuation Story, where we decode the numbers behind India's biggest transformations. If this resonated with you, share it with someone who should know about India's electric future.