Inside Polycab’s Growth: What the Revenue Tells Us

A critical analysis of Polycab India’s revenue growth strategy

Hello readers,

Welcome to another edition of The Valuation Story.

I am Akash, and this week, we are diving deep into Polycab India Limited to explore what is driving its revenue growth and where the cracks appear. This critical thesis breaks down the company’s growth strategy, future outlook, and the risks that impact future growth.

Also, follow me on LinkedIn and Instagram.

In this newsletter, we will explore how Polycab India Limited has grown in the past and what the future holds for this company.

Disclaimer:

This research is only for learning and information purpose. It share my personal veiws based on data available to the public and my personal research on Polcab India Limited. It is not investment advice or a stock tips. Please do your own research and think carefully before making any financial descisions. Part does not future.

Let’s start with a story…

Polycab India Limited is India’s leading manufacturer of Wire and Cables and and they are doing business in Fast Moving Electrical Goods, where they make switchgear, fan and other home appliance, switches, lights and solar products, but by doing EPC (Engineering, Procurement, and Construction) business too, it takes on full projects - from planning and buying materials to building an electric system. This helps the company move from just selling products to offering a complete solution. It’s a smart move because it gives the company more control, adds more value, and could lead to the biggest profit.

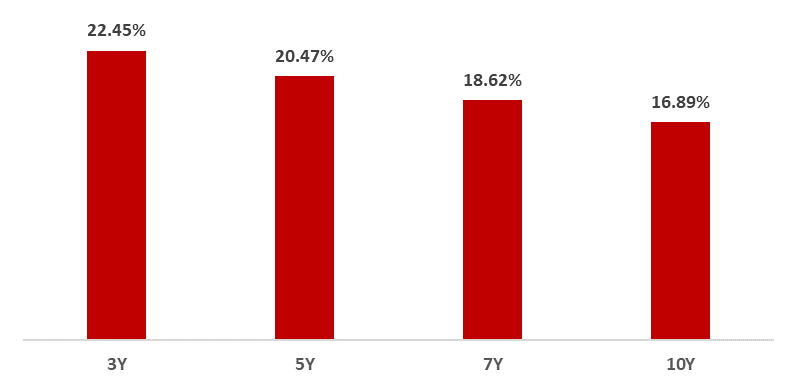

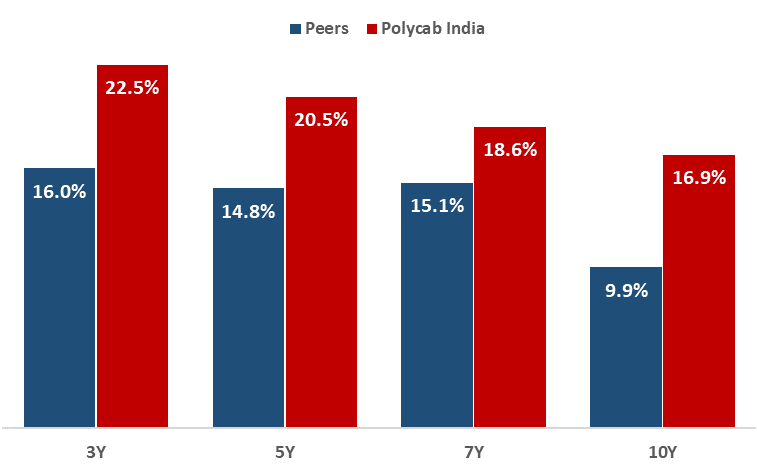

In FY 2024-25, the company reached Rs. 22,408 crores of total revenue with 24.2% growth from last FY 2023-24 with Rs. 18,039 crores of total revenue. The company has shown strong revenue growth, with a CAGR of 22.45%, 20.47%, 18.62% and 16.89% over the past 3, 5, 7 and 10 years. It is selling ~84% of the segment of wire and cables, ~7.5% from FMEG goods and the remaining position from EPC business and others of the total revenue of the company. I observe that the wires and cables’ share in revenue is declining over the years because of share of EPC business is increasing, and the share of FMEG revenue is almost flat at 7-9% over the past few years.

Revenue growth from the wire and cables business is ~18% compared to last year, which is lower, the revenue from FMEG goods grew with ~28.9% as compare to last year, but the revenue growth from the EPC business is sharp rising with ~143%+ which is new high in revenue mix of the company. It means the company is getting more and more projects in the EPC business, which is a positive sign for the company. The company's export share is declining compared to last year, where the current share of export is ~6.2% of total sales, and the rest of the revenue is from domestic sales.

I compare with peers who are doing business in the same wires and cables industry and FMEG sectors. Most of the peers are smaller companies than Polycab India, but they are growing at median CAGRs of 16.04%, 14.79%, 15.14%, and 9.91% over the past 3, 5, 7, and 10 years, respectively, where Polycab India is winning this race.

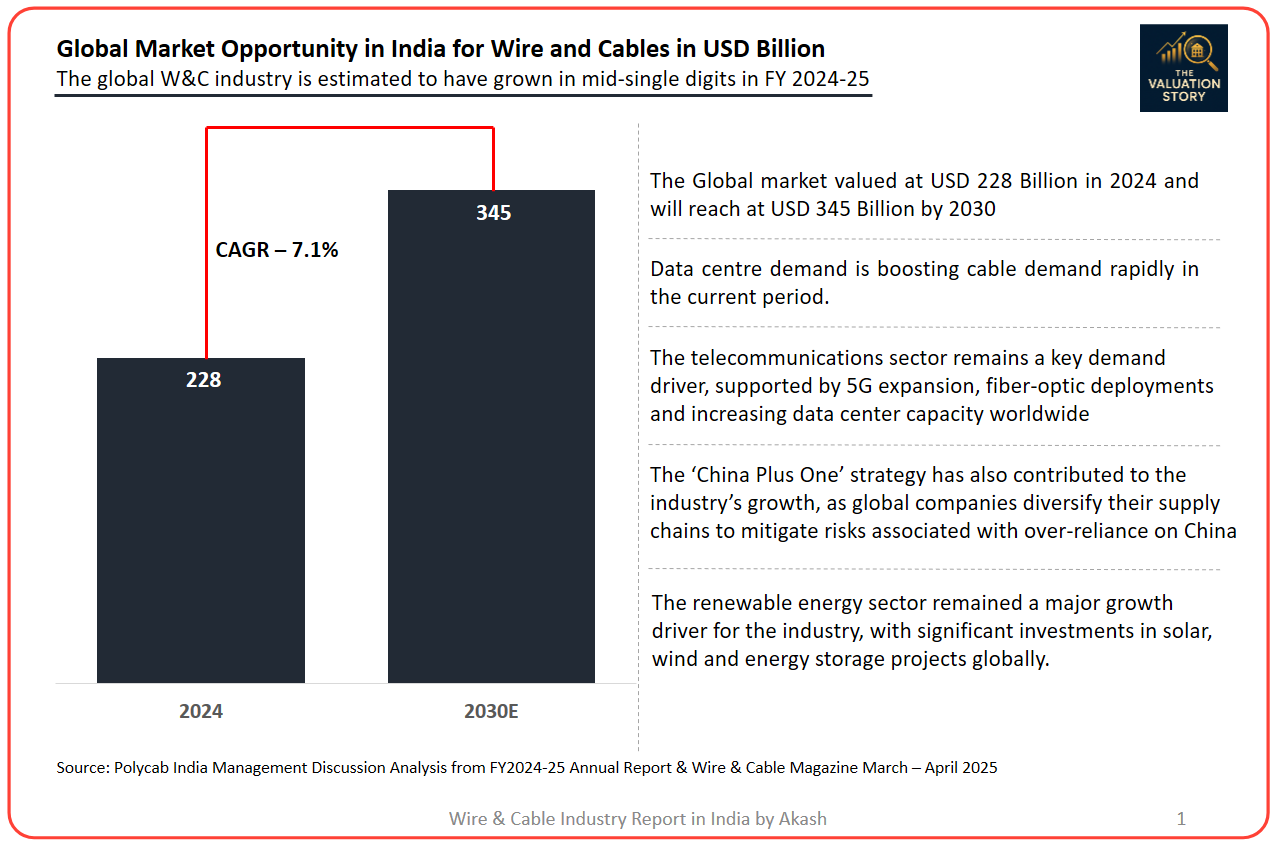

Global Wires and Cables Market

The global wire and cable (W&C) industry is quietly powering up. In 2024–25, it grew steadily—nothing flashy, but strong and solid. Why? Because the world is upgrading everything: electricity, cities, factories, internet—you name it.

Clean energy is a big reason. Countries like the U.S., China, and those in Europe are going all-in on solar and wind power. That means more cables are needed—especially big ones that carry electricity over long distances, cables for solar panels, and special cables for offshore wind farms in the ocean. Just the U.S. alone plans to add over 300 GW of solar and wind power by 2029. Europe? About the same. That’s massive.

But that’s not all. The internet is growing too fast. With 5G, data centres, and fibre internet spreading everywhere, the need for high-speed fibre cables is rising. Countries in North America, Europe, and Asia-Pacific are putting serious money into building better, faster broadband.

Another interesting trend? The world isn’t relying on China as much for manufacturing. Instead, companies are looking to places like India, Vietnam, South Korea, Taiwan, and Mexico to make wires and cables. This is giving Indian manufacturers a huge boost in exports.

What’s next? This industry still has room to grow. Clean energy, better internet, factory automation, and electric vehicles will all need high-quality cables. Cities are expanding, power needs are going up, and mobility is going electric.

India is in a great position here. It has strong factories, better quality products, and lower costs compared to many countries. As more global companies look for new, reliable partners outside of China, India’s wire and cable makers have a big opportunity to shine.

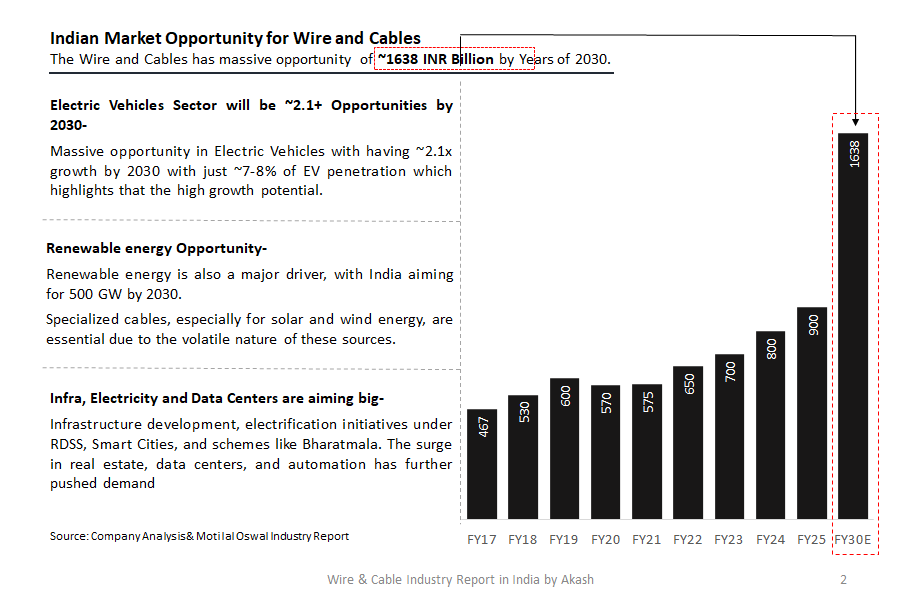

Indian Wires and Cables Market

The Indian W&C industry grew by ~12% this year. That’s faster than many other sectors. Growth isn’t random—it’s tied to how the economy is being wired, quite literally. Even with a pause during elections, project execution didn’t stop. Ministries like Railways and Highways kept spending. That shows strong intent, not just announcements. Post-election, capital spending picked up again. Budget for FY26 raised infra spending by 17%. That’s not just numbers—it’s fresh demand for cables in metros, smart cities, roads, and power grids.

Power is no longer just about supply. It’s about how you transmit it. Solar and wind energy need cables that can handle tough environments. More renewables = more specialised cable demand. Residential housing launches hit a 10-year high. Sales hit a 15-year peak. Real estate is now a cable-first business because electrical work starts early in construction. EVs and data centres are becoming cable-hungry. EVs need fast-charging systems. Data centres need structured, fire-resistant cabling. These aren't trends—they’re demand shocks. Private capex is still below its peak, but it’s rising. That shows confidence is returning. Cement, auto, and electronics sectors are expanding quietly. That’s smart money, not hype. The defence sector is evolving fast. India is moving toward local production. Cables built for tanks, ships, and secure systems? That's a whole new vertical opening up. People now prefer certified cables over cheap ones. Awareness is rising. Branded players with reach and trust are winning. Safety isn’t optional anymore—it’s demanded.

Organised players are using tech, compliance, and distribution to gain share. The unorganised sector will struggle to keep up unless it upgrades. India’s W&C industry is now growing faster than GDP. That’s a signal—it’s becoming a backbone industry, not just a support player. Consumption is rising. Borrowing costs are easing. Industries are utilising their capacities better. This mix sets up the private sector for a capex comeback. The industry is no longer just about wires. It’s about resilience, speed, energy transition, and quality. It has quietly become the nervous system of India's infrastructure play.

What Management is thinking

The company achieved its Project Leap target guidance to reach a Rs. 20,000 crores top line by FY26, ahead of schedule, with the CY24 top line already at Rs. 21,000+ crores. Now, management is focusing on a new project called Project Leap for the next 5-year guidance until FY30, which will set the foundation for long-term growth and align with the government’s “Viksit Bharat 2047" vision.

Guidance for-

1. Wires and cables-

The company plans to grow its wires and cables business at about 1.5 times the market’s growth rate. The domestic wires and cables market is expected to grow 1.5 to 2 times faster than India’s real GDP. So, if India’s GDP grows at 6.5%, the market could grow between 10% and 13%. This means the company is targeting 15% to 20% growth. If GDP rises to 7%, the industry may grow 10.5% to 14%, pushing the company’s growth estimate to around 16% to 21%. These projections assume the company can maintain its market outperformance, which depends on strong execution, product differentiation, and competitive pricing.

2. International Business:

Under Project Spring, the company plans to increase its international business to over 10% of total revenue. In FY25, this stood at around ~6%. The global wires and cables market is expected to grow at a CAGR of 7.5% and reach $410 billion by FY30. This creates a strong growth runway. Additionally, the "China+1" strategy is pushing global players to diversify their sourcing, which benefits Indian manufacturers. The company expects solid growth in exports, backed by a strong order book and positive demand trends. To scale efficiently, it is creating three dedicated divisions to serve OEMs, distributors, and EPC players globally. While the strategy is sound, actual gains will depend on execution, pricing power, and the ability to build long-term global partnerships

3. FMEG Business

The FMEG sector is expected to grow at 8–10% in the near to mid-term. The company targets 1.5x to 2x this rate, aiming to become a Top 3 player by FY30 with sustainable profits. In Q4 FY25, FMEG revenue grew 33% YoY — the fifth straight quarter of strong performance. Solar products grew 2.5x in FY25 and are now the third-largest FMEG segment, supported by schemes like PM Surya Ghar Yojana. Management sees strong future demand, driven by real estate growth and focused efforts in distribution, product innovation, and influencer engagement.

4. EPC business

The EPC business is expected to keep a stable revenue pace over the next two years, supported by a strong and visible order book. This segment is likely to contribute a mid- to high single-digit share to the company’s total revenue. As of March 31, 2025, the total open order book stood at ₹70 billion. This includes ₹40 billion from RDSS projects, which will be delivered over the next 2 to 3 years, and ₹30 billion from the BharatNet scheme in Bihar, with capital work spread across three years and operating services over ten years. In addition, the company has emerged as the lowest bidder for more BharatNet projects worth ₹41 billion. While the pipeline is strong, timely execution, margin discipline, and working capital management will be key to value creation in this segment.

India’s macro environment stays strong, supported by a growing workforce, fast digitisation, and solid domestic demand. Key indicators like digital payments and auto sales show steady growth. Government policies are also helping, especially with a major infrastructure push through RDSS, BharatNet, and the "Viksit Bharat 2047" vision. After the elections, public spending picked up in Q2 FY25.

Real estate is booming and is expected to touch ₹1 trillion by 2030. Corporate capex is also rising, thanks to healthier balance sheets and better capacity use. RBI rate cuts expected in 2025 may further support this trend.

Polycab plans to invest ₹60–80 billion under Project Spring over five years, focused on wires and cables. FY25 capex was ₹9.6 billion, with similar levels planned annually through FY27. These investments are expected to deliver strong asset turns of 4x–5x.

The company is also increasing spending on R&D and automation to improve product quality and stay ahead of the market. Alongside this, focus on talent development and ESG under Project Spring shows a long-term commitment to sustainable and profitable growth.

Volume growth is supported by two key areas: the strong external environment and the company’s internal strategy.

India’s economy is growing well, helped by a rising population, better technology use, and strong domestic demand. Government spending on big infrastructure projects like RDSS and BharatNet is creating more demand for wires and cables. The real estate sector is also booming and is expected to grow sharply by 2030. Private companies are investing more, too, as their finances improve. Rate cuts expected from the RBI in 2025 will support even more growth. New sectors like data centres, EVs, solar, and defence are also pushing up demand, especially for specialised cables. Government schemes like PM Surya Ghar Yojana are boosting solar product sales.

On the company side, Polycab is investing ₹60–80 billion over five years under Project Spring to expand capacity, especially in wires and cables. FY25 capex was ₹10 billion — the highest ever. The company’s market share has grown sharply in the organised space, from 18–19% in FY19 to 26–27% in FY25. It is expanding distribution, launching new products (especially in FMEG), and entering premium categories like fans and lighting. Polycab has also restructured into verticals to better target different industries and is rapidly growing its global footprint, now reaching 84 countries. The China+1 strategy is also helping Indian players like Polycab gain global orders.

Lastly, while copper price dropped and high inventory slowed sales briefly in FY25, this was temporary. Demand stayed strong, especially from real estate, and sales picked up once prices normalised.

Why Operating Leverage is Improving

As Polycab sells more, its factories are running at higher capacity — touching over 80% in peak Q4 FY25. This spreads fixed costs across more output, making operations more efficient. Scale benefits are kicking in, especially in FMEG, where rising sales help absorb overheads. Plus, the product mix is shifting toward higher-margin items like wires and premium FMEG (switchgear, solar), which lift profitability faster than costs.

What Can Temporarily Hurt Leverage:

However, new capex projects take time to scale. Early on, when utilization is low, these assets pull margins down. Also, in Q2 FY25, the company sold off old inventory instead of producing more — this reduced factory usage, hurting leverage. Lastly, higher ad spends, R&D, and new team costs (like vertical-focused sales teams) are increasing upfront costs, which could offset some gains from the scale.

Short Insights from this analysis-

Polycab started as a wires and cables company but is now moving toward becoming a full electrical solutions brand. Along with cables, it now makes fans, lights, and switches, and also works on big electrical projects. This change shows that the company is thinking ahead and wants to grow in many directions.

In FY25, Polycab earned ₹22,408 crores, growing 24.2% from last year. Even though most of the money still comes from wires and cables (84%), other parts of the business are rising fast. The EPC business went up by 143%, and the FMEG business grew by 29%. This means the company is slowly building a strong future beyond just cables.

Compared to other companies, Polycab’s growth is faster. Whether we look at 3, 5, or even 10 years, it is moving ahead of the pack. The way Polycab is adding new products and services shows that it wants to become a one-stop solution for electrical needs. This forward journey gives confidence that the company can become a big leader in the full electrical space over the next few years.

Until next time,

Spend consciously. Value wisely. Live intentionally.

— Akash

The Valuation Story

I will also recommend these insights: