The Margin Tells the Truth

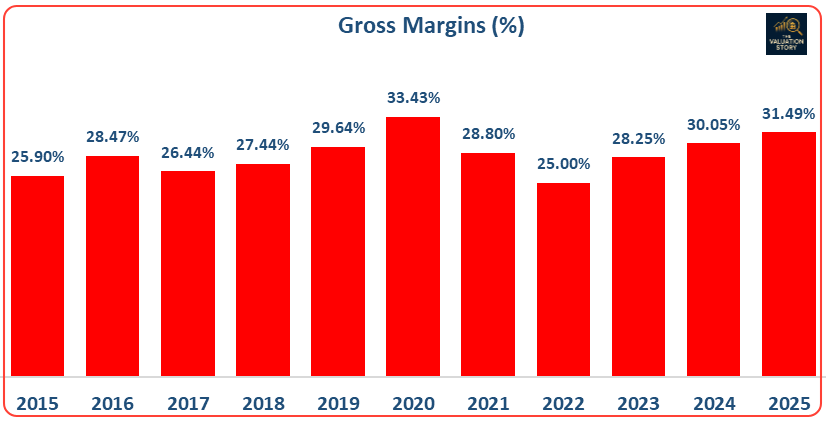

At 31.5%, Polycab’s gross margin tells a deeper story — of efficiency, strategy, and a business that’s scaling without breaking.

Hello readers,

Welcome to another edition of The Valuation Story.

I am Akash, and today I want to take you through something that looked like a small number at first, but the more I looked at it, the more I understood how deep it is.

Let’s begin.

A few days ago, I was working on Polycab’s valuation model. Everything was going fine. I was checking revenue growth, segment-wise performance, volume guidance, everything. Then I came across one number that made me stop — gross margin.

The gross margin for FY25 is 31.5%. Now, to be honest, when I first saw it, I didn’t think much. I had seen gross margins around 25–28% in manufacturing companies. So this number didn’t surprise me immediately.

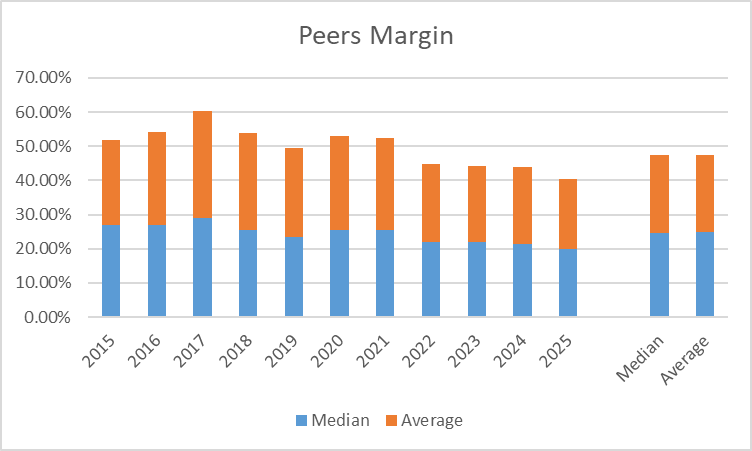

But then, I did one small thing — I compared it with my peers.

KEI Industries, Finolex Cables, RR Kabel — none of them are even close. KEI’s gross margin is around 24%, Finolex is below 20%, and RR Kabel is somewhere near 18%. That’s when I realised — wait, 31.5% is very high in this kind of business.

And when you see a number like that, you can’t ignore it. Because it tells you something is going right inside the business.

So I started digging deeper.

Polycab’s core business is wires and cables. It contributes nearly 84% of the total revenue. This is a segment where pricing depends heavily on raw materials like copper and aluminium, and both are highly volatile. If you can still maintain a 31%+ gross margin, that means you have strong internal systems.

Then I looked at how this margin has moved over the years.

In FY21, it was around 28.8%. In FY22, it dropped to 25%. Then it bounced back to 28.25% in FY23, 30.05% in FY24, and now 31.49% in FY25. This consistent improvement told me that the company is not just growing top line — it’s also improving the quality of its earnings.

So what’s driving this?

First, I saw that factory utilisation has improved. In Q4 FY25, it crossed 80%. That means their manufacturing units are being used more efficiently. When that happens, fixed costs like electricity, labour, and rent get divided across more units. This reduces the cost per unit, and the margin automatically improves. This is called operating leverage.

Second, the company is improving its product mix. The FMEG segment — which includes fans, lights, switches, etc. is still small in total revenue (~7.5%), but it grew by 29% this year. These products generally have higher gross margins compared to wires. As this segment grows, the overall margin will improve.

Then there’s the EPC business. In FY25, it grew by over 143%. Now, this segment may not bring high margins, but it brings big volume. It supports plant utilisation and gives a better return on capital over time. That also helps protect margins indirectly.

One more thing I noticed — Polycab has very good control over its inventory and material procurement. When I looked at the COGS breakdown, their raw material efficiency stood out. They’ve maintained tight control despite volatile commodity prices. That’s not easy.

And this is not happening by luck.

The company is doing heavy capex — ₹60,000 to ₹80,000 crore planned under Project Spring over 5 years. FY25 capex alone was around ₹10,000 crore. This will expand capacity, bring automation, and improve efficiency further. But it also means that for the next 1–2 years, there could be pressure on the margin due to new capacity not being fully utilised.

That’s okay, because I’m not looking at this quarter by quarter. I’m looking at how the margin behaves over the full business cycle. And from that view, Polycab is clearly showing signs of long-term strength.

Another thing I liked, while revenue is rising fast, the margin is rising slowly. That shows me this growth is real, not artificial. When both top line and margin rise together stably, the company becomes more predictable, more cash-generating, and easier to value with confidence.

When I model this now in my DCF, I’m not treating gross margin as a static number. I’m building it as a slow-moving curve, slightly dipping during capex years, but rising again as utilisation improves and high-margin segments grow.

Most people skip this part. They just plug one number into Excel and move on.

But for me, this one number — 31.5% gross margin — told me more about the business than the full investor presentation.

It showed me that Polycab knows how to manage costs, balance growth, and run a manufacturing company with focus and patience.

It’s not a flashy company. But this kind of performance speaks quietly — and clearly.

Until next time,

Spend consciously. Value wisely. Live intentionally.

— Akash

The Valuation Story

Disclaimer:

This research is only for learning and informational purposes. It shares my personal views based on public data and personal research on Polycab India Limited. This is not investment advice or a stock tip. Please do your research before taking any financial decision.

I will also recommend these insights: